Stock Options- The Easiest Options Strategy (Update 2020)

Stock Options- The Easiest Options Strategy (Update 2020) Free Tutorial Download

What you’ll learn

-

An easy to implement, highly profitable options trading strategy in one of the most liquid ETN (VXX)

-

How to avoid being burst when volatility peaks!

-

Earn money; have an extra income

-

Achieve an expert level knowledge on volatility trading

-

Dramatically improve options trading skills

-

Forget technical analysis and indicators that produce non-consistent results

Requirements

-

A practice or live account in an options brokerage firm

-

Eager and motivated to learn

Note: I am actively trading this strategy and sharing it on my website!

You should enroll in this course if you:

1. … bought an Udemy stock options course, but you feel it is theoretical or does not teach you a proper and proven strategy

2. … have basic options knowledge and need a proper strategy to apply it in the market

3. … lack consistency trading stocks, forex or even stock options (derivatives)

4. … are not profitable scalping stocks (or using stock swing trading approach)

5. … use technical analysis that is not producing positive results

6. … use trading indicators and they deliver non-profitable signals

7. … shorted volatility and it produced huge drawdowns in a Volatility spike

8. … are willing to start trading with a proper trading plan (clear entry and exit instructions / pure mechanical)

**** ENROLL NOW and learn an easy, proven, medium risk and profitable trading strategy and join our growing community of profitable volatility traders! ****

What students say about the course:

Darrin Vincent: “It’s nice to have strategies that work…”

Velentin H.: “If you want to understand the ins and outs of volatility trading, this is the one!”

Hugh Todd: “Mr. Branco does an excellent job of describing a trading strategy he uses, and in the process explains some basics of the volatility market. In the May 2018 update, he also shares the pitfalls that can happen when one doesn’t follow the rules. Well done.”

Roy Kirby: Proven strategy with positive returns. Not an options course! If you have some basic knowledge on options this course is for you. You can apply the directions (mechanical) to enter and exit trades. Great value here!

————————————————————————————————————–

**** To be clear: this course is NOT for people who want to learn about stock options! You have very good free and paid courses at Udemy! This course will teach you an applied options strategy and to profit from it with proven market edge, clear guidelines and proper money management! ****

*** UPDATE 2020: Backtest 2019 proves the consistency and profitability of this sound strategy! ***

This course is a description of an options trading strategy, based on statistical analysis, with proven results in the long term that I am applying weekly! I trade exclusively volatility-based strategies with options, being this one of my core due to its profitability for income generation and complement the CROC Trade (also another Udemy course that I developed)! I quit trading stocks, stock options and forex several years ago and now specialized on this asset!

In this course you will learn an options-based trading strategy (entry-level, very easy to implement – without adjustments!) that will give you weekly capital appreciation! It is a proven options income strategy, with a market edge, that will boost your portfolio returns! This is not a course on stock options trading! It uses a volatility ETN, VXX, which has much more price predictability than any other stock or forex markets! And I will show and prove you how!

This course starts with the volatility analysis fundamentals and then moves to the development of the options trading strategy, including its rationale and proving its edge over the market. Then moves to the strategy optimization and finish with its options trading rules that will give you an easy implementation, in a controlled risk environment!

After this course you will have access to a very consistent and highly profitable options income strategy that some institutions and professional traders are applying!

This options course describes a full investment methodology with detailed explanation of its rationale, expected outcome and its optimization process. It includes details on several backtests developed to support its robustness and consistency as well as alternative tests presented to support the chosen criteria.

This options trading methodology should be a very good add-on to increase the return of your Stock or ETF portfolio! If you are trying to scalp stocks or using stock options on your trading and not achieving results, move to a new asset class!

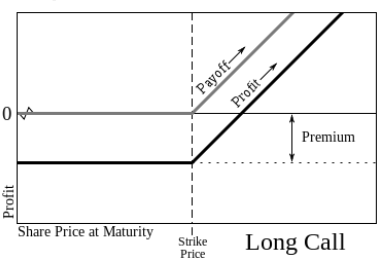

Options are derivatives and could be stock options that have stock as their base asset. In this case, we trade a derivative, which is volatility! We are trading derivatives of a derivative!

Only basic options knowledge is needed as well as a brokerage account (either live or practice account if you want to test it first)!

I am currently trading this options methodology on VXX as one of my trade arsenal, every week! It will be shown on my live trades record.

The strategy can be used in IRA accounts.

————————————————————————————————————–

Course content:

My Background / Experience

Price Action: VIX® Index vs Stock

Why Volatility investing is much more interesting

Volatility trading risks (and how to control them)

Instruments of Volatility Trading

VIX® futures Term Structure

Contango, Backwardation and Roll Yield

The Trading approach

Strategy statistical Edge and optimization

Options Trading Rules (The Plain Vanilla / Mechanical)

Advanced Options Strategy Rules (extra profitability on discretionary approach)

Hedging Strategy with VIX options

Results obtained

All future course updates will be for free as well as email support for any questions that may arise.

————————————————————————————————————–

This course is for you if:

a) you are trading stocks, forex, stock options (derivatives) or even volatility products and not achieving desired results;

b) you already enrolled in any other Udemy basic options course and want to learn a profitable trading strategy;

c) you are fed up with technical analysis, stock price patterns, indicators that do not deliver results.

ENROLL NOW and start to earn money today!

This options management style can be implemented with a minimum suggested account value of USD500.

Options are derivatives and could be stock options that have stock as their base asset. In this case, we trade a derivative, which is volatility! We are trading derivatives of a derivative!

This options trading approach is targeting investors who want to learn a more advanced strategy, improve their learning curve and add a new consistent and profitable methodology that would increase their wealth and diversify risk.

——————————————————————————————————————-

Stock trading, forex trading or even stock options (derivatives) trading involves risk. Be aware that not all of the trades will be winners; the goal is to be profitable in the long term!

- Anyone that already enrolled in other Udemy theoretical options courses and now want to learn a proven and real strategy

- Anyone that is passionate about trading like I am

- Anyone interested to earn money (have an extra income)

- Anyone interested to stop loosing money on stock or forex trading

- Anyone interested in options trading, especially on volatility products

- Anyone that want to improve their trading consistency

- Anyone interested to have an additional profitable strategy to add to his portfolio

Download Stock Options- The Easiest Options Strategy (Update 2020) Free

https://xmbaylorschool-my.sharepoint.com/:u:/g/personal/mossh_baylorschool_org2/EeQ95ngq92VJpguMrsbL9IsBWR10TSKwonkfICgHehHdtg

https://anonfiles.com/d629Z3L3od

https://drive.google.com/file/d/1ZCJSkj2jR3YtHeFU0_LEVQFLbobPWjBL/view?usp=sharing

https://uptobox.com/h8l6kzqgqsn8